instacart tax form canada

Perfect for independent contractors and small businesses. Sent to full or part-time employees.

Partnering With Stride To Bring Shoppers Affordable Insurance

Form 1099-NEC from Instacart details the amount you made on the app.

. Groceries delivered to your door in as little as an hour. Tax tips for Instacart Shoppers. As always Instacart Express members get free delivery on orders over 35 per retailer.

Get it delivered to your doorstep. All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year. Your total business miles are 10000.

Independent contractors are not subject to tax withholding. Instacart delivery starts at 399 for same-day orders over 35. The IRS requires Instacart to provide your 1099 by January 31st each year.

It seems simple right. Schedule the delivery Get your groceries in as little as an hour or when you want them. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. When Instacart extended a conditional offer to you to provide services on the Instacart platform we obtained authorization from you to perform a background check. Confirm your tax information eg name address and Social Security Number or Employer Identification Number is correct via Stripe Express and make any necessary.

When youre ready tap Next. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Someone making 65k in QC pays 19946 in taxes for a rate of 3069.

You will get an Instacart 1099 if you earn more than 600 in a year. Quebec residents have to apply for GSTHST and QST numbers. Confirm once you confirm youre registered for GSTHST.

5000 x 5 2500 which is the amount you can claim. Independent contractors who earn more than 600 a year will get an Instacart 1099-NEC. Background checks normally process within 10 business days.

If you have other business activities that are registered under a different business number you file a separate T2125 form for it. Then theres an expense section. There will be a clear indication of the delivery fee when you are choosing your delivery window.

Instacart sends its independent contractors Form 1099-NEC. Form 1099-NEC is a new name for Form 1099-MISC. New customers may be eligible for free delivery promotions.

Order fresh groceries online Shop at Instacart SSO Branding from any device. Visit this TurboTax link for more information on tax deductions for the self-employed. Currently the Instacart Shopper app doesnt track the miles you drive in a single easily readable form.

X Get Instacart SSO Branding delivered in 3 easy steps. The 1099-NEC form reports earnings earned outside of a typical job. So this is just a reminder to anyone on this sub that moving to Quebec is rarely a good financial decision despite cheaper housing and other living expenses.

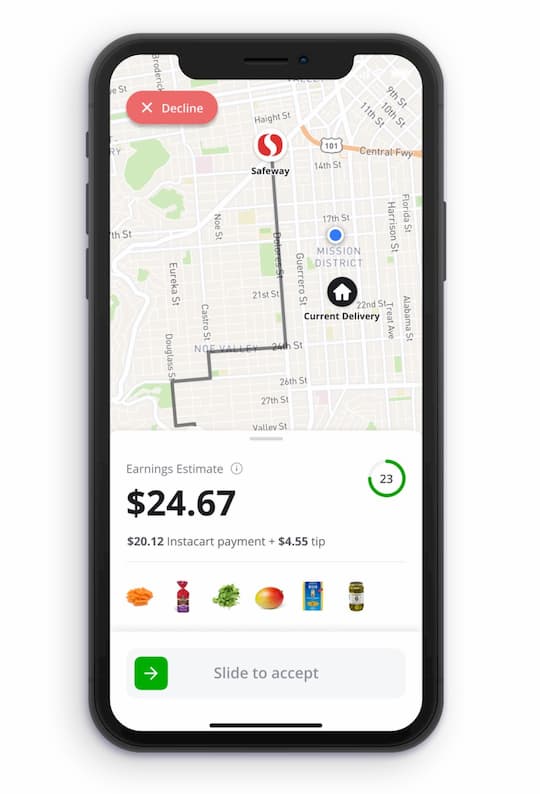

As you can see in the example above this Instacart batch is a total of 42 miles so you know approximately how far you. Instacart on the other hand isnt so simple I. Instacart delivery starts at 399 for same-day orders 35 or more.

By January 7 2022. Filing taxes in canada. To actually file your Instacart taxes youll need the right tax form.

Instacart contracts Checkr Inc to perform all Shopper background checks. The W-4 forms are for employees and also help you set up tax withholding. Well its more complex than that.

He should use the industry code for Instacart in his T2125 form. As I mentioned above come tax time you fill out your expenses on an IRS form called Schedule C. In the menu select Tax identification.

10000 20000 5 or 50. Learn the basic of filing your taxes as an independent contractor. It shows your total earnings plus how much of your owed tax has.

Lets take a look at them below. There will be a clear indication of the delivery fee when you are choosing your delivery window. However you can look through all of your completed batches and see how many miles you drive for Instacart in total.

Filing taxes in canada. In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes. There may be a pickup fee.

Hi folks I joined instacart in February 2018 and this is my first full year with instacart which means its time to do my taxes. What tax forms do Instacart shoppers get. As always Instacart Express members get free delivery on orders 35 or more per retailer.

You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. Knowing how much to pay is just the first step. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Fees start at 399 for same-day orders over 35. Branding for Instacart SSO Pages. I got one from Uber since I also work for them part time and its super simple and easy.

Instacart sends its independent contractors Form 1099-NEC. From re-routing deliveries during snowstorms to connecting customers with coupons and deals for their favorite brands to updating over half a billion grocery data lines every nightour efforts bring Instacart closer to being the operating system for the grocery industry. The Instacart 1099 tax forms youll need to file.

Youll need to create an account and agree to e-delivery ie agree to receive your 1099 tax form electronically via Stripe Express to preview and download your 1099 tax form. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. According to the website someone making 150k in BC pays 46341 in taxes for a rate of 3089.

Youll need to fill out a few tax forms as an Instacart driver. Tax forms needed for full-service shoppers. If you earned at least 600 delivery groceries over the course of the year including base pay and tips from customers you can expect this form by January 31.

Instacart uses W-9s for independent contractor positions to verify your legal name address and tax identification number. Instacart on the other hand isnt so simple I. Independent contractors have to sign a contractor agreement and W-9 tax form.

In the Instacart Shopper app tap the Account icon in the bottom right corner. To get started create an account select the store you want to shop and place your order. All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year.

Background check processing time. Profit or Loss for Business Theres an income section where you add up any of your business income from Doordash Uber Eats Grubhub Instacart Uber or Lyft or any other gigs that you contract with. This used to be reported to you on a 1099-MISC but that changed starting in 2020.

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How To Get Instacart Tax 1099 Forms Youtube

Taxes In Canada R Instacartshoppers

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Instacart Driver Jobs In Canada What You Need To Know To Get Started

What Is A Gst Hst Number Canada Only Instacart Onboarding

16 Must Know Instacart Shopper Tips Tricks 2022 Make More Money

Instacart Jobs In Calgary North Ab Instacart Com

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

When Does Instacart Pay Me A Contracted Employee S Guide

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Instacart Driver Jobs In Canada What You Need To Know To Get Started

How Much Can You Make A Week With Instacart 2022 Real Earnings